Pt61 Printable Form

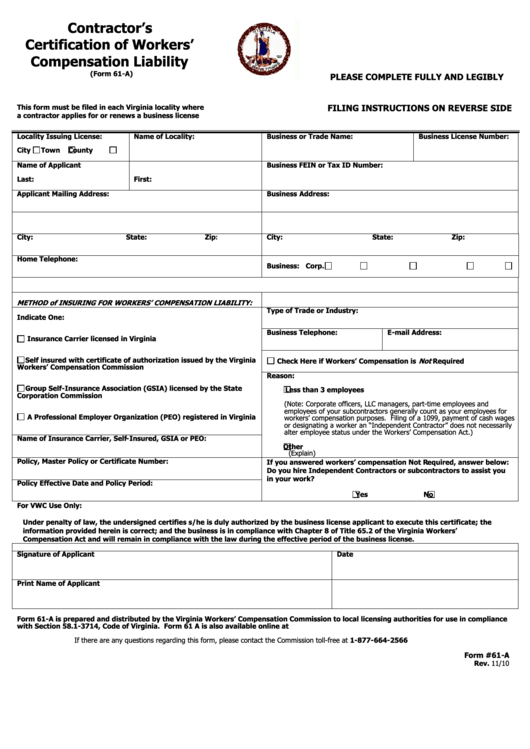

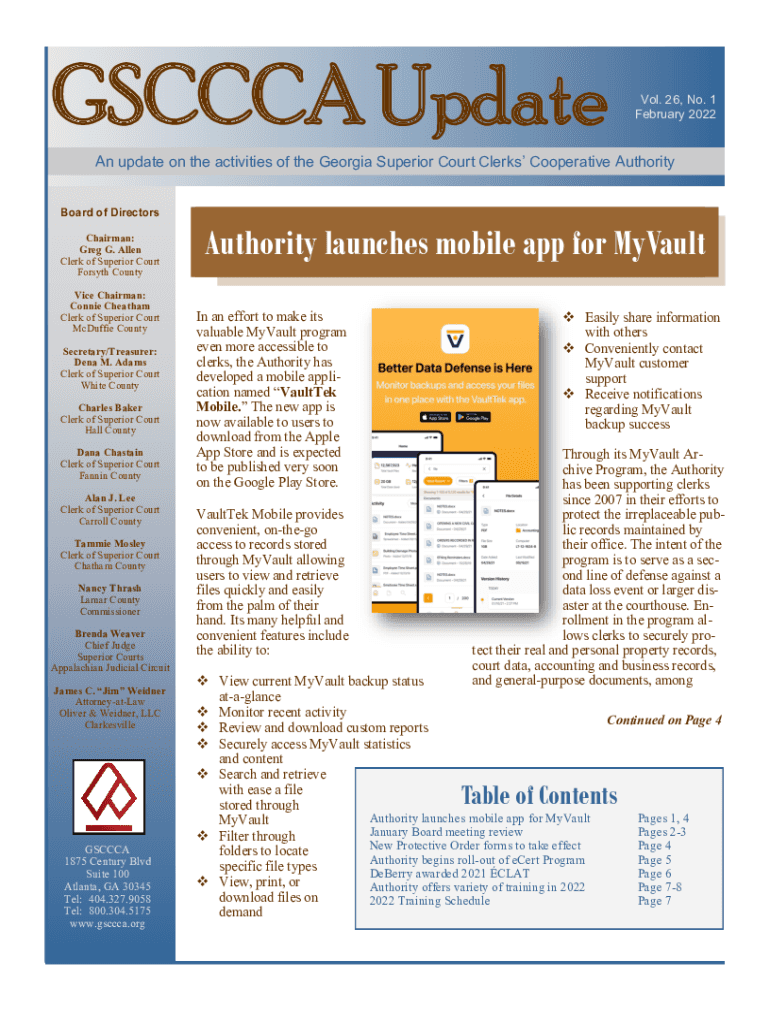

Pt61 Printable Form - This is the form you will file with your deed at the clerk's office. The real estate transfer tax is based upon the property's sale price at the rate of $1 for the first. A copy of the certificate must be. Enter the relevant details such as your name, address, date of. It serves as documentation for the transfer tax that may apply during this process. 1859 illinois tax forms and templates are collected. These documents are in adobe acrobat portable document format (pdf). After the filer completes the form online, a copy should be printed to file in the clerk's office along with the deed documents. Actual value of consideration received by seller. You will notice three arrows in figure 7. It serves as documentation for the transfer tax that may apply during this process. If you would like to proceed and. These documents are in adobe acrobat portable document format (pdf). The real estate transfer tax is based upon the property's sale price at the rate of $1 for the first. Illinois department of revenue returns, schedules, and registration and related forms and instructions. The purchaser, at the seller’s request, must provide the. Up to $50 cash back 1. 1859 illinois tax forms and templates are collected. This is the form you will file with your deed at the clerk's office. A copy of the certificate must be. Start by downloading the pt61 form from the official website of the ministry of home affairs. The real estate transfer tax is based upon the property's sale price at the rate of $1 for the first. Up to $50 cash back 1. 1859 illinois tax forms and templates are collected. A copy of the certificate must be. The real estate transfer tax is based upon the property's sale price at the rate of $1 for the first. 1859 illinois tax forms and templates are collected. This is the form you will file with your deed at the clerk's office. It serves as documentation for the transfer tax that may apply during this process. Illinois department of revenue. Up to $50 cash back 1. Enter the relevant details such as your name, address, date of. The real estate transfer tax is based upon the property's sale price at the rate of $1 for the first. Print form and bring with you or mail with deed to clerk's office for filing; After the filer completes the form online, a. 1859 illinois tax forms and templates are collected. These documents are in adobe acrobat portable document format (pdf). The form is completed on the. The purchaser, at the seller’s request, must provide the. You will notice three arrows in figure 7. 1859 illinois tax forms and templates are collected. Enter the relevant details such as your name, address, date of. Actual value of consideration received by seller. This is the form you will file with your deed at the clerk's office. Print form and bring with you or mail with deed to clerk's office for filing; This is the form you will file with your deed at the clerk's office. Enter the relevant details such as your name, address, date of. The purchaser, at the seller’s request, must provide the. The form is completed on the. Start by downloading the pt61 form from the official website of the ministry of home affairs. It serves as documentation for the transfer tax that may apply during this process. This is the form you will file with your deed at the clerk's office. These documents are in adobe acrobat portable document format (pdf). Start by downloading the pt61 form from the official website of the ministry of home affairs. The purchaser, at the seller’s request,. If you would like to proceed and. It serves as documentation for the transfer tax that may apply during this process. Enter the relevant details such as your name, address, date of. The form is completed on the. After the filer completes the form online, a copy should be printed to file in the clerk's office along with the deed. The purchaser, at the seller’s request, must provide the. The form is completed on the. You will notice three arrows in figure 7. Actual value of consideration received by seller. 1859 illinois tax forms and templates are collected. After the filer completes the form online, a copy should be printed to file in the clerk's office along with the deed documents. You will notice three arrows in figure 7. It serves as documentation for the transfer tax that may apply during this process. A copy of the certificate must be. Up to $50 cash back 1. Up to $50 cash back 1. These documents are in adobe acrobat portable document format (pdf). Illinois department of revenue returns, schedules, and registration and related forms and instructions. The form is completed on the. Enter the relevant details such as your name, address, date of. The real estate transfer tax is based upon the property's sale price at the rate of $1 for the first. If you would like to proceed and. 1859 illinois tax forms and templates are collected. It serves as documentation for the transfer tax that may apply during this process. The purchaser, at the seller’s request, must provide the. A copy of the certificate must be. After the filer completes the form online, a copy should be printed to file in the clerk's office along with the deed documents. Start by downloading the pt61 form from the official website of the ministry of home affairs.Printable Pt 61 Form

Printable Pt 61 Form

Pt 61 Printable Form Fill and Sign Printable Template Online US

Printable Pt 61 Form Printable Computer Tools

Printable Pt61 Form Printable Word Searches

Pt 61 Form Printable

Pt 61 Form Printable Printable Templates

Form 61 A Fillable Printable Forms Free Online

Ga pt 61 printable form Fill out & sign online DocHub

Pt61 Printable Form Ataglance Printable Calendar

You Will Notice Three Arrows In Figure 7.

This Is The Form You Will File With Your Deed At The Clerk's Office.

Actual Value Of Consideration Received By Seller.

Print Form And Bring With You Or Mail With Deed To Clerk's Office For Filing;

Related Post: