Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

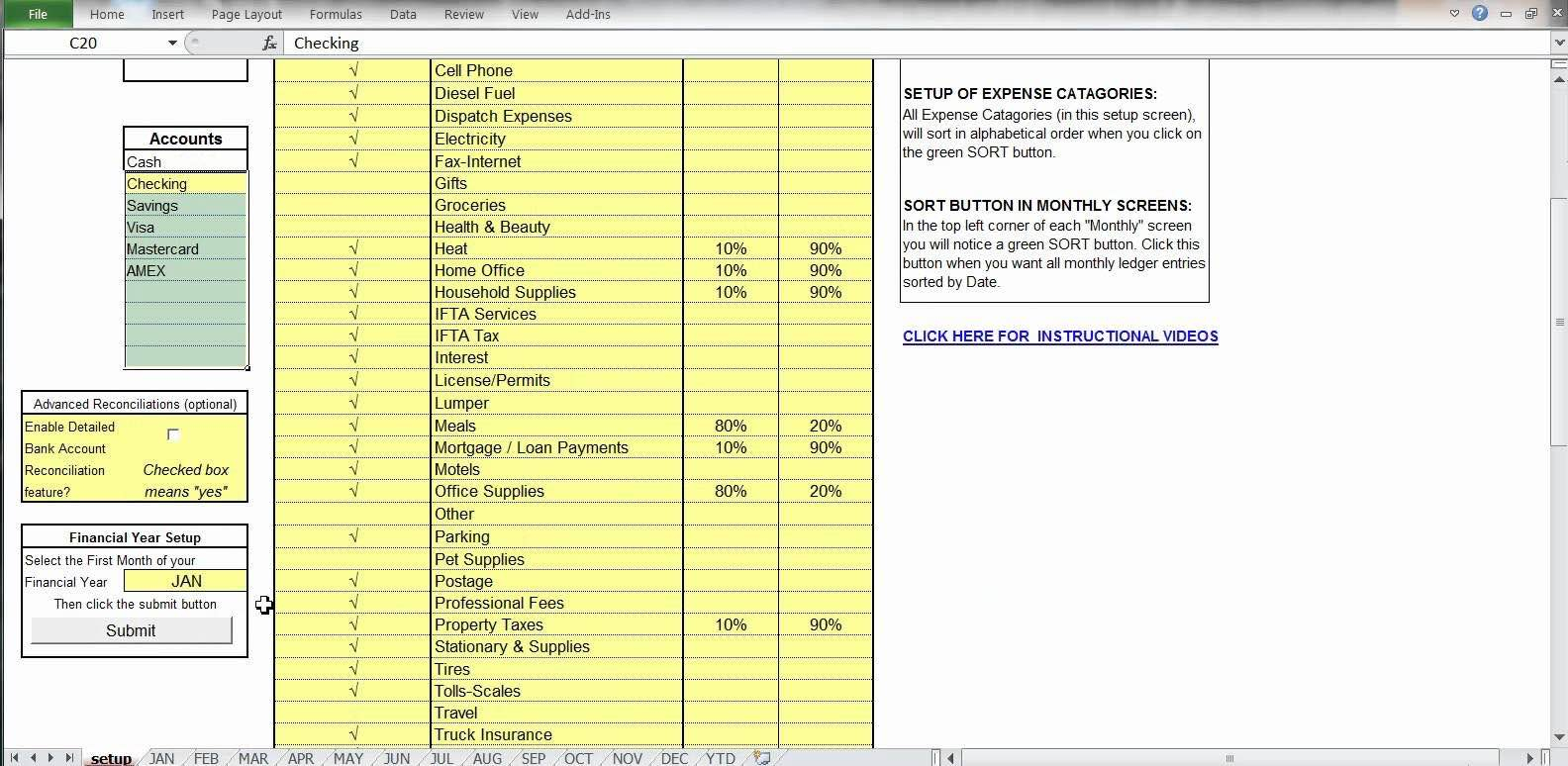

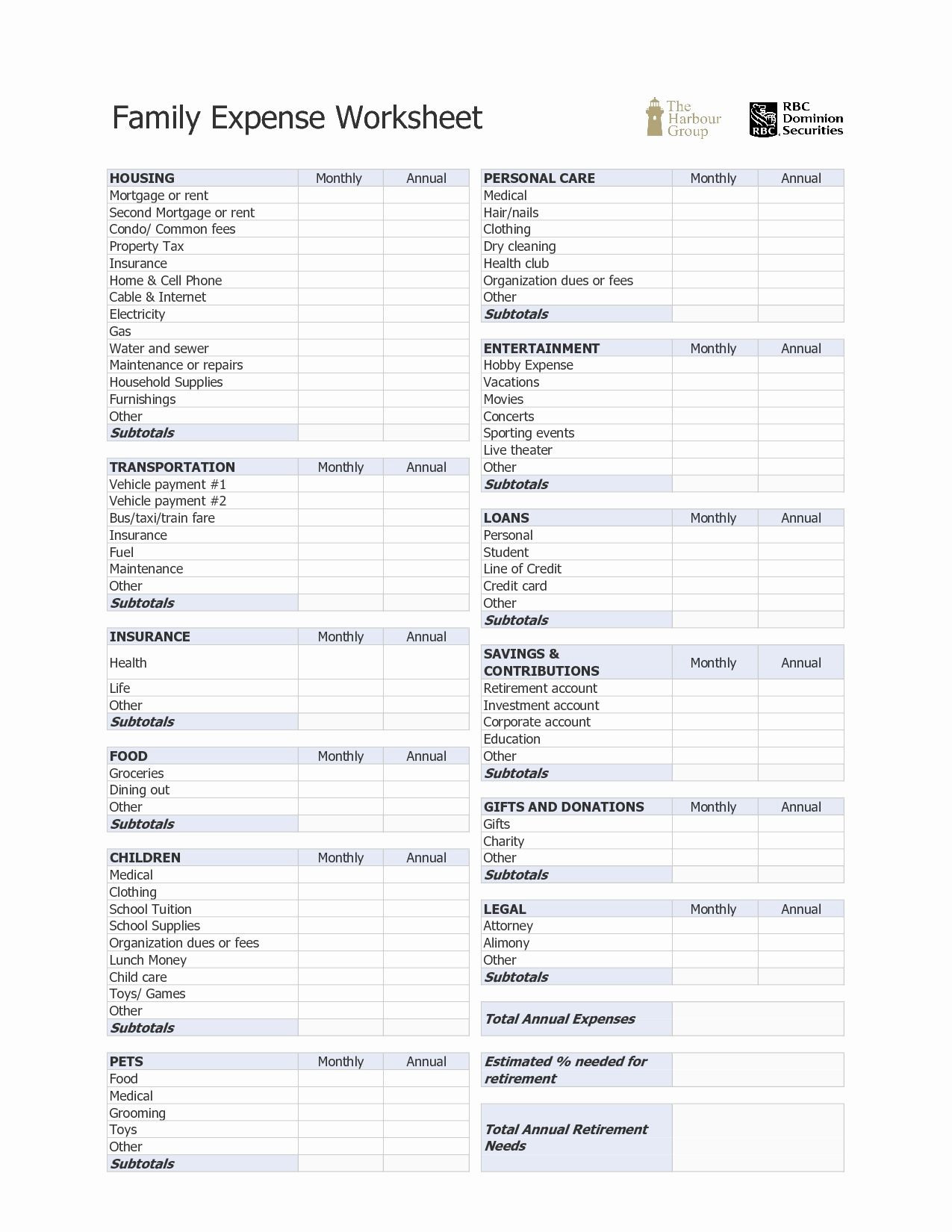

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet - Up to $50 cash back truck driver tax deductions are expenses that truck drivers can deduct from their taxable income, reducing the amount of tax they owe. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Below are potential opportunities to save on your. In order for an expense to be deductible, it must be considered. These deductions can be used to reduce the. Finding and tracking tax deductions for truck drivers can help you save more to protect your business. Expenses are deductible only if you itemize deductions. Diesel fuel expense is one of the largest expenses for truckers and owner operators in a tax year. C itizens band rad o. Use a truck driver tax deductions worksheet template to make your document workflow more streamlined. One of them includes the ability to determine and utilize the deductions you are eligible for, minimizing some of the available financial risks, increasing your revenues, or even. Diesel fuel expense is one of the largest expenses for truckers and owner operators in a tax year. Below are potential opportunities to save on your. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Here are some suggestions to help you. Up to $50 cash back truck driver tax deductions are designed to reduce the amount of taxes owed by truck drivers at the end of the year. It is designed to simplify tax filing requirements and maximize deductions. Expenses are deductible only if you itemize deductions. In order for an expense to be deductible, it must be considered. Use a truck driver tax deductions worksheet template to make your document workflow more streamlined. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Expenses are deductible only if you itemize deductions. One of them includes the ability to determine and utilize the deductions you are eligible for, minimizing some of the available financial risks, increasing your revenues, or even. Here are some suggestions to. Read on to find the best deductions for your company. Diesel fuel expense is one of the largest expenses for truckers and owner operators in a tax year. Expenses are deductible only if you itemize deductions. These deductions can be used to reduce the. C itizens band rad o. Finding and tracking tax deductions for truck drivers can help you save more to protect your business. Expenses are deductible only if you itemize deductions. C itizens band rad o. In order for an expense to be deductible, it must be considered. Up to $50 cash back truck driver tax deductions are designed to reduce the amount of taxes owed. Below are potential opportunities to save on your. Up to $50 cash back truck driver tax deductions are designed to reduce the amount of taxes owed by truck drivers at the end of the year. Here are the tax deductions & expense list for truckers & truck driver: Diesel fuel expense is one of the largest expenses for truckers and. In order for an expense to be deductible, it must be considered. Diesel fuel expense is one of the largest expenses for truckers and owner operators in a tax year. Read on to find the best deductions for your company. Below are potential opportunities to save on your. These deductions can be used to reduce the. In order for an expense to be deductible, it must be considered. Use a truck driver tax deductions worksheet template to make your document workflow more streamlined. Expenses are deductible only if you itemize deductions. Diesel fuel expense is one of the largest expenses for truckers and owner operators in a tax year. Truck driver tax deductions the purpose of. Here are some suggestions to help you. Here are the tax deductions & expense list for truckers & truck driver: Up to $50 cash back truck driver tax deductions are expenses that truck drivers can deduct from their taxable income, reducing the amount of tax they owe. Below are potential opportunities to save on your. This deductible expenses worksheet helps. Read on to find the best deductions for your company. Here are some suggestions to help you. In order for an expense to be deductible, it must be considered. Up to $50 cash back truck driver tax deductions are expenses that truck drivers can deduct from their taxable income, reducing the amount of tax they owe. This deductible expenses worksheet. C itizens band rad o. Read on to find the best deductions for your company. Diesel fuel expense is one of the largest expenses for truckers and owner operators in a tax year. This deductible expenses worksheet helps otr drivers organize tax deductible business expenses. Use a truck driver tax deductions worksheet template to make your document workflow more streamlined. Up to $50 cash back truck driver tax deductions are expenses that truck drivers can deduct from their taxable income, reducing the amount of tax they owe. C itizens band rad o. Read on to find the best deductions for your company. Expenses are deductible only if you itemize deductions. Use a truck driver tax deductions worksheet template to make. Here are some suggestions to help you. Here are the tax deductions & expense list for truckers & truck driver: This deductible expenses worksheet helps otr drivers organize tax deductible business expenses. One of them includes the ability to determine and utilize the deductions you are eligible for, minimizing some of the available financial risks, increasing your revenues, or even. Finding and tracking tax deductions for truck drivers can help you save more to protect your business. Diesel fuel expense is one of the largest expenses for truckers and owner operators in a tax year. Read on to find the best deductions for your company. Use a truck driver tax deductions worksheet template to make your document workflow more streamlined. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Up to $50 cash back truck driver tax deductions are designed to reduce the amount of taxes owed by truck drivers at the end of the year. C itizens band rad o. Up to $50 cash back truck driver tax deductions are expenses that truck drivers can deduct from their taxable income, reducing the amount of tax they owe. Below are potential opportunities to save on your.Printable Truck Driver Expense Owner Operator Tax Deductions

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Tax Deduction Worksheet For Truck Drivers Printable Word Searches

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Truck Driver Tax Expense Worksheet

Truck Driver Tax Expense Deductions List

Truck Driver Tax Deductions Worksheet Truck Driver T Trucker

Truck Driver Tax Deductions Worksheet Truck Driver T Trucker

Truck Driver Expenses Worksheet Tax Worksheet Deductions Exp

Expenses Are Deductible Only If You Itemize Deductions.

It Is Designed To Simplify Tax Filing Requirements And Maximize Deductions.

In Order For An Expense To Be Deductible, It Must Be Considered.

These Deductions Can Be Used To Reduce The.

Related Post: