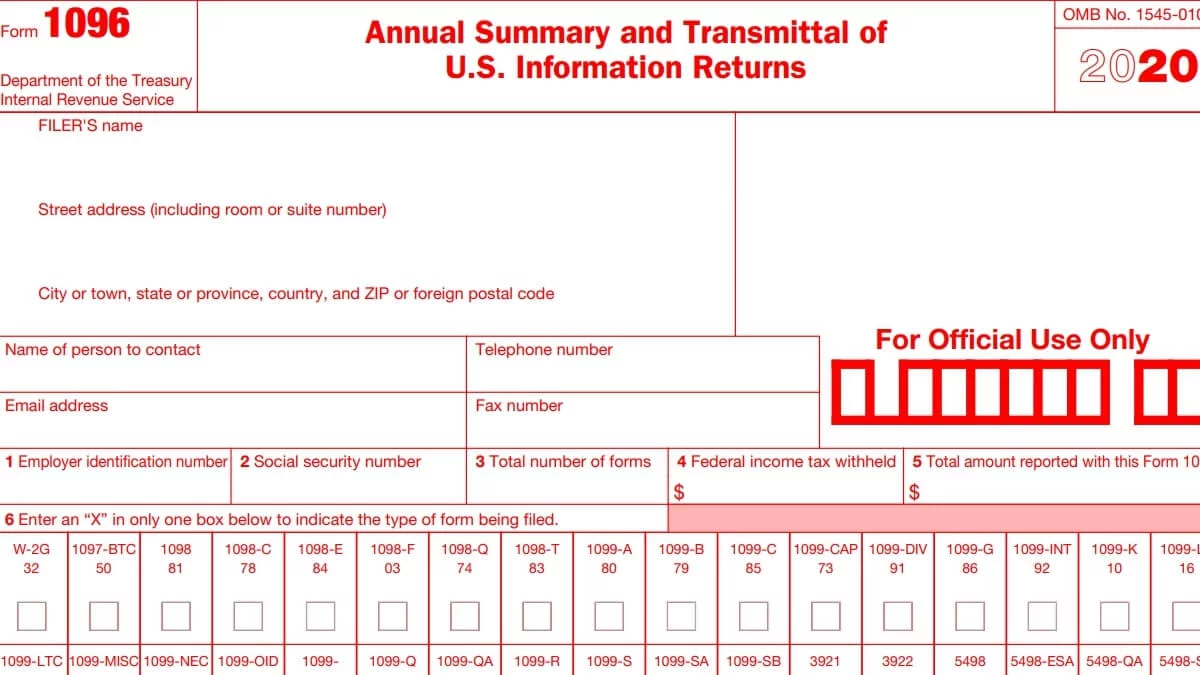

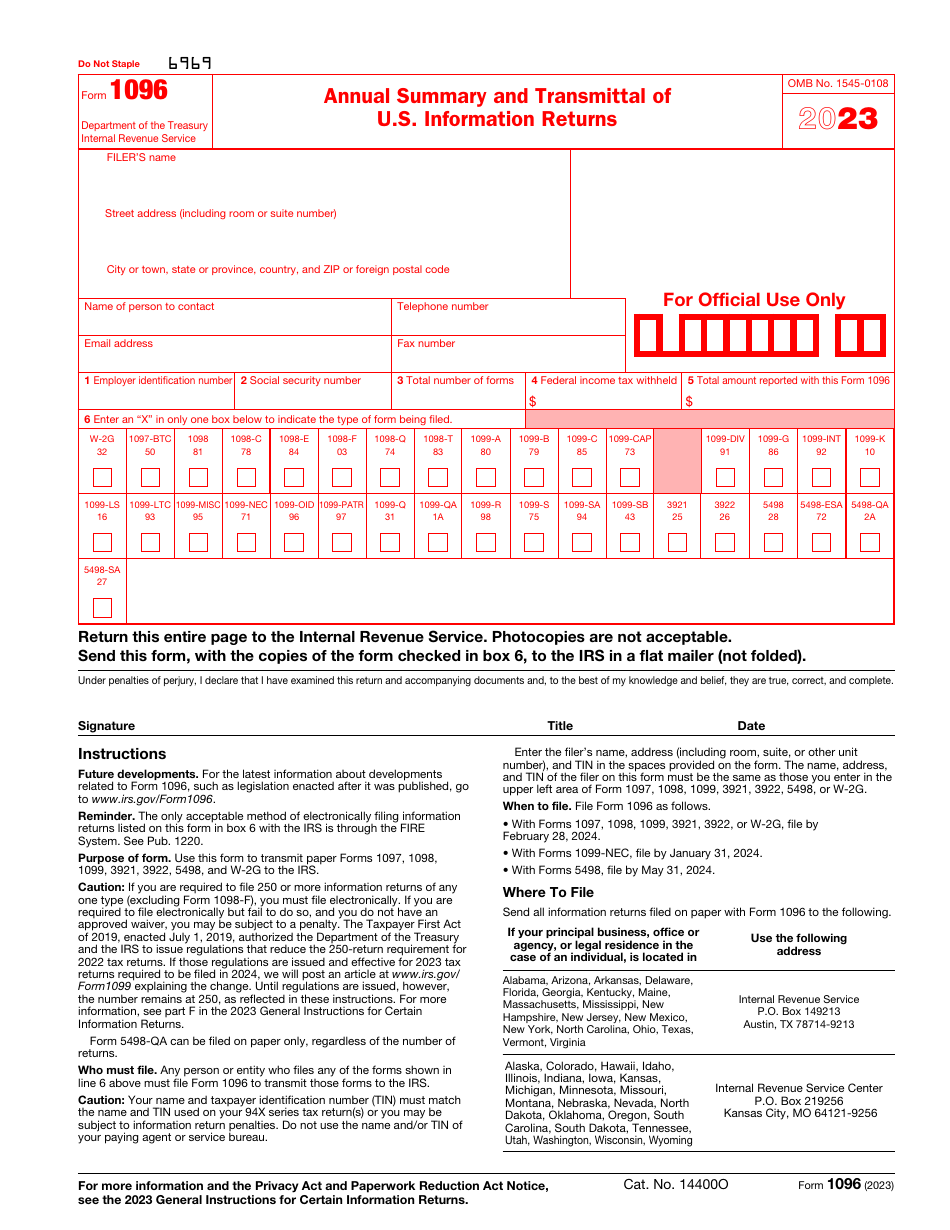

Printable Form 1096

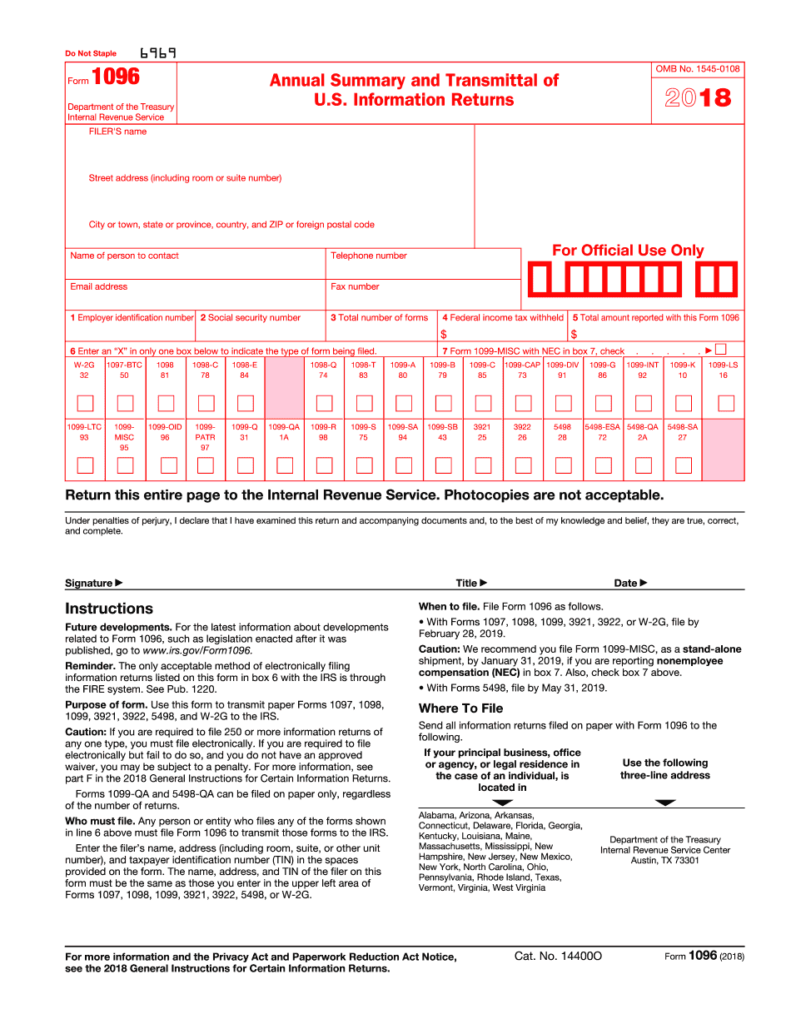

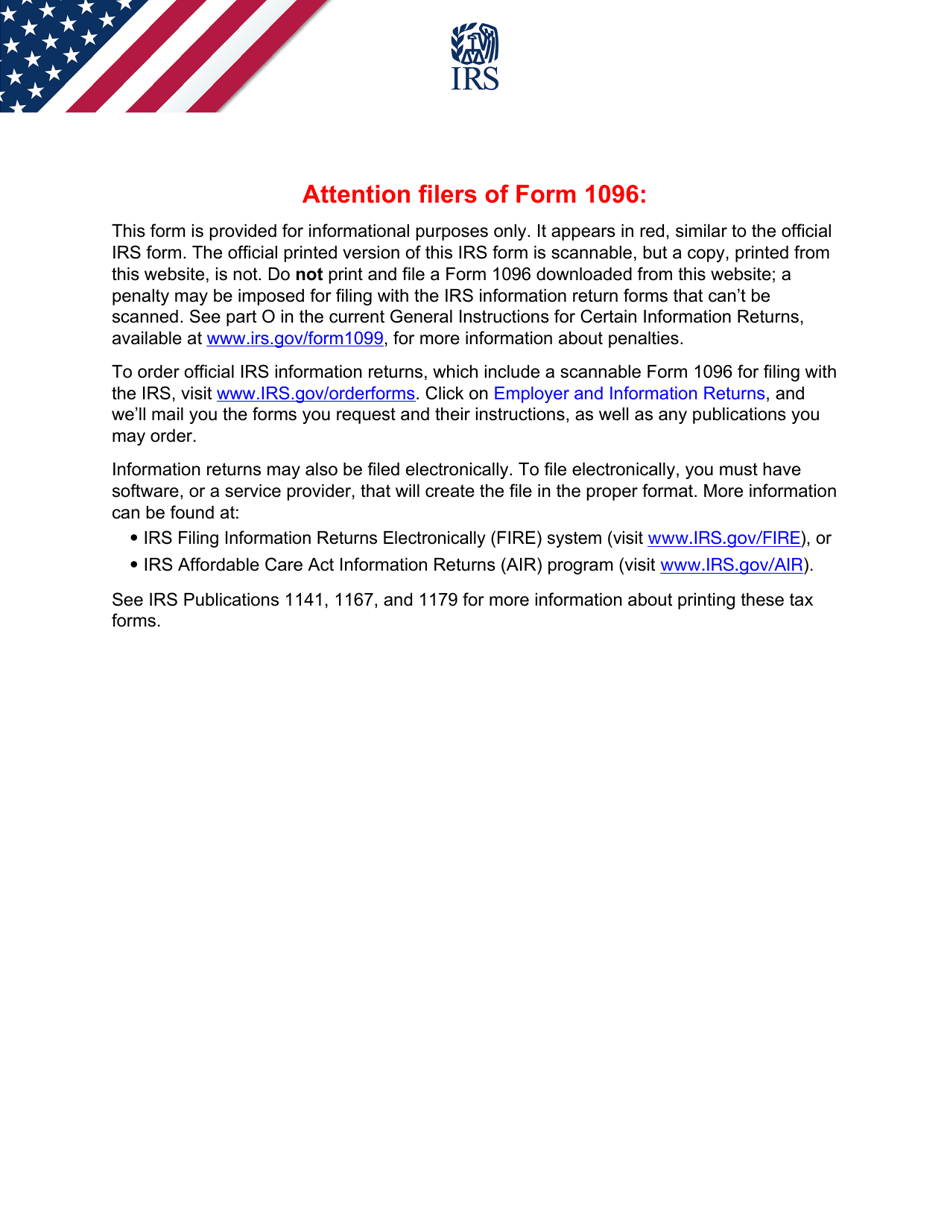

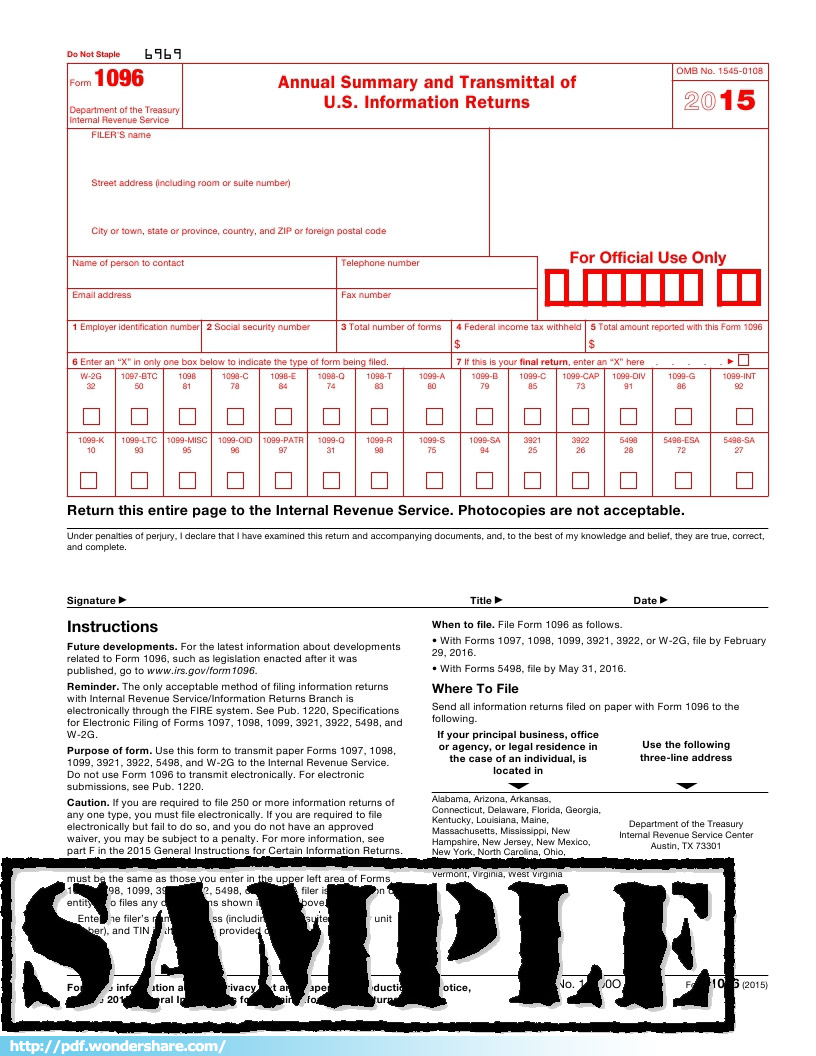

Printable Form 1096 - This page provides the addresses for taxpayers and tax professionals to mail. Illinois department of revenue returns, schedules, and registration and related forms and instructions. Download or print the 2024 federal form 1096 (annual summary and transmittal of u.s. Instructions for form 1096 pdf. Money back guaranteeedit on any device24/7 tech support Form 1096, the annual summary and transmittal of us information returns form, provides the irs with details about one or more of seven different types of tax information that need to be. Click on employer and information returns, and we’ll mail. Download or print the 2024 federal (annual summary and transmittal of u.s. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. This guide provides detailed instructions for completing irs form 1096, which serves as the transmittal form for various information returns, including forms 1099, 1098, 5498, 3921,. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. 100% money back guarantee3m+ satisfied customers Form 1096 is an information return form that summarizes the information about any payment that you've made to any recipient for tax purposes. Find the latest revision, instructions, and other related forms and publications on. Information returns) for free from the federal internal revenue service. Information returns) (2024) and other income tax forms from the federal internal revenue service. File form 1096 in the calendar year following the year for which the information is being reported, as follows. Download or print the 2024 federal form 1096 (annual summary and transmittal of u.s. Form 1096, the annual summary and transmittal of us information returns form, provides the irs with details about one or more of seven different types of tax information that need to be. Instructions for form 1096 pdf. Download or print the 2024 federal (annual summary and transmittal of u.s. Once corrections are identified, use the most current version of the 1096 form, available on the irs website, to file the revision. Edit on any device5 star ratedfast, easy & securemoney back guarantee Mark the form as a correction by checking the. Information returns) for free from the. Below are ways to obtain tax forms, instructions and publications: To order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. File form 1096 in the calendar year following the year for which the information is being reported, as follows. File form 1096 in the calendar year following the year for which. Below are ways to obtain tax forms, instructions and publications: Instructions for form 1096 pdf. Illinois department of revenue returns, schedules, and registration and related forms and instructions. Download or print the 2024 federal (annual summary and transmittal of u.s. Once corrections are identified, use the most current version of the 1096 form, available on the irs website, to file. This guide provides detailed instructions for completing irs form 1096, which serves as the transmittal form for various information returns, including forms 1099, 1098, 5498, 3921,. Make sure to order scannable forms 1096 for filing with the irs. To order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Money back guaranteeedit. File form 1096 in the calendar year following the year for which the information is being reported, as follows. Mark the form as a correction by checking the. These documents are in adobe acrobat portable document format (pdf). This guide provides detailed instructions for completing irs form 1096, which serves as the transmittal form for various information returns, including forms. Mark the form as a correction by checking the. Edit on any device5 star ratedfast, easy & securemoney back guarantee Form 1096 is also titled annual summary and. Form 1096 is an information return form that summarizes the information about any payment that you've made to any recipient for tax purposes. Once corrections are identified, use the most current version. These documents are in adobe acrobat portable document format (pdf). Or, if you prefer, simply print. Once corrections are identified, use the most current version of the 1096 form, available on the irs website, to file the revision. File form 1096 in the calendar year following the year for which the information is being reported, as follows. Business taxpayers can. Form 1096 is an information return form that summarizes the information about any payment that you've made to any recipient for tax purposes. File form 1096 in the calendar year following the year for which the information is being reported, as follows. Below are ways to obtain tax forms, instructions and publications: Edit on any device5 star ratedfast, easy &. Once corrections are identified, use the most current version of the 1096 form, available on the irs website, to file the revision. Download or print the 2024 federal form 1096 (annual summary and transmittal of u.s. Information returns) for free from the federal internal revenue service. Edit on any device5 star ratedfast, easy & securemoney back guarantee Or, if you. Download or print the 2024 federal form 1096 (annual summary and transmittal of u.s. To order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Money back guaranteeedit on any device24/7 tech support Form 1096 is also titled annual summary and. Below are ways to obtain tax forms, instructions and publications: File form 1096 in the calendar year following the year for which the information is being reported, as follows. Make sure to order scannable forms 1096 for filing with the irs. Or, if you prefer, simply print. Instructions for form 1096 pdf. Form 1096, the annual summary and transmittal of us information returns form, provides the irs with details about one or more of seven different types of tax information that need to be. This page provides the addresses for taxpayers and tax professionals to mail. Download or print the 2024 federal form 1096 (annual summary and transmittal of u.s. Edit on any device5 star ratedfast, easy & securemoney back guarantee Once corrections are identified, use the most current version of the 1096 form, available on the irs website, to file the revision. Information returns) (2024) and other income tax forms from the federal internal revenue service. Form 1096 is also titled annual summary and. Below are ways to obtain tax forms, instructions and publications: Illinois department of revenue returns, schedules, and registration and related forms and instructions. Form 1096 is an information return form that summarizes the information about any payment that you've made to any recipient for tax purposes. These documents are in adobe acrobat portable document format (pdf). This guide provides detailed instructions for completing irs form 1096, which serves as the transmittal form for various information returns, including forms 1099, 1098, 5498, 3921,.Printable 1096 Form 2018

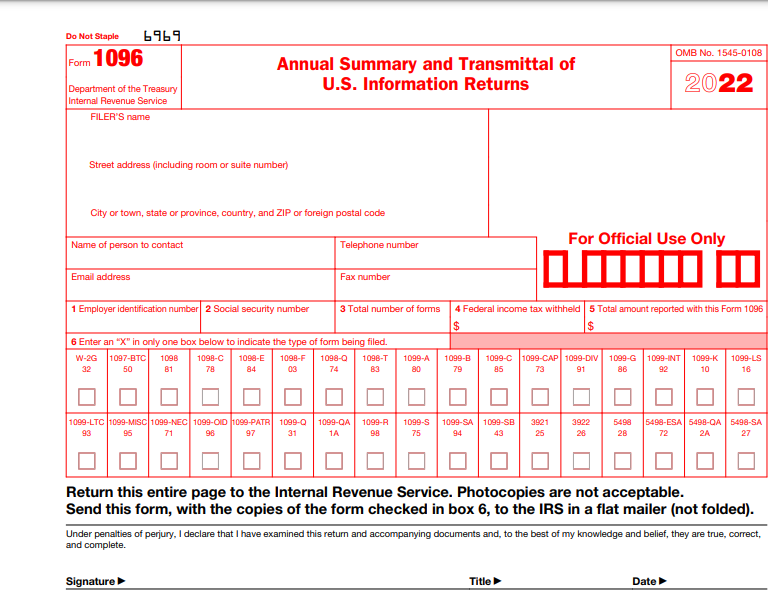

1096 IRS PDF Fillable Template 2022 With Print and Clear Buttons

IRS Form 1096. Annual Summary and Transmittal of U.S. Information

2018 2019 IRS Form 1096 Editable Online Blank In PDF Printable Form 2021

IRS Form 1096 Download Printable PDF or Fill Online Annual Summary and

IRS 1096 Form Download, Create, Edit, Fill and Print

Irs Form 1096 Fillable Universal Network

Irs 1096 Printable Form Printable Forms Free Online

Irs 1096 Printable Form Printable Forms Free Online

IRS Form 1096 Download Fillable PDF or Fill Online Annual Summary and

Money Back Guaranteeedit On Any Device24/7 Tech Support

A Form 1096 Is Also Known As An Annual Summary And Transmittal Of U.s.

Business Taxpayers Can File Electronically Any Form 1099 Series Information Returns For Free With The Irs Information Returns Intake System.the Iris.

100% Money Back Guarantee3M+ Satisfied Customers

Related Post: