Free Printable Promissory Note

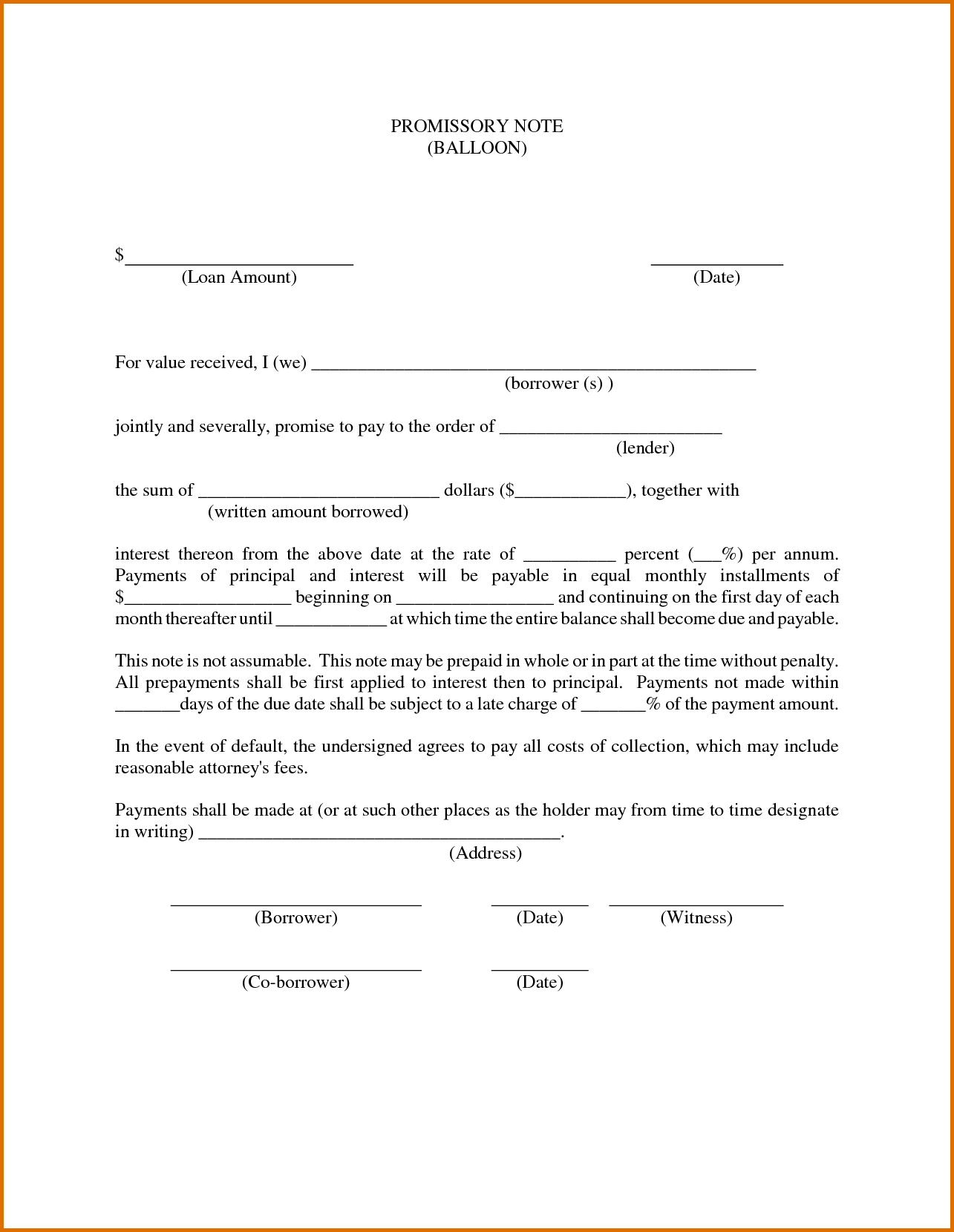

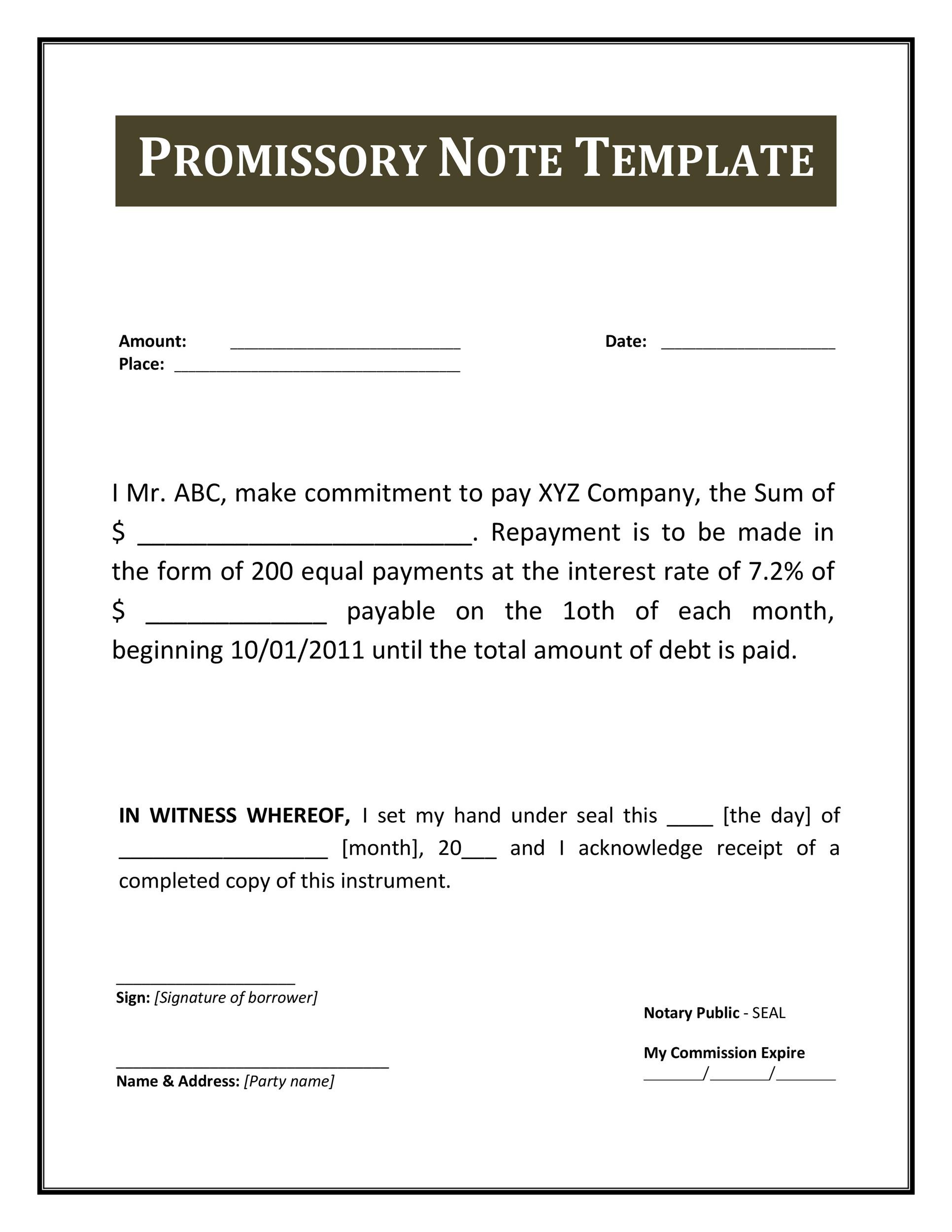

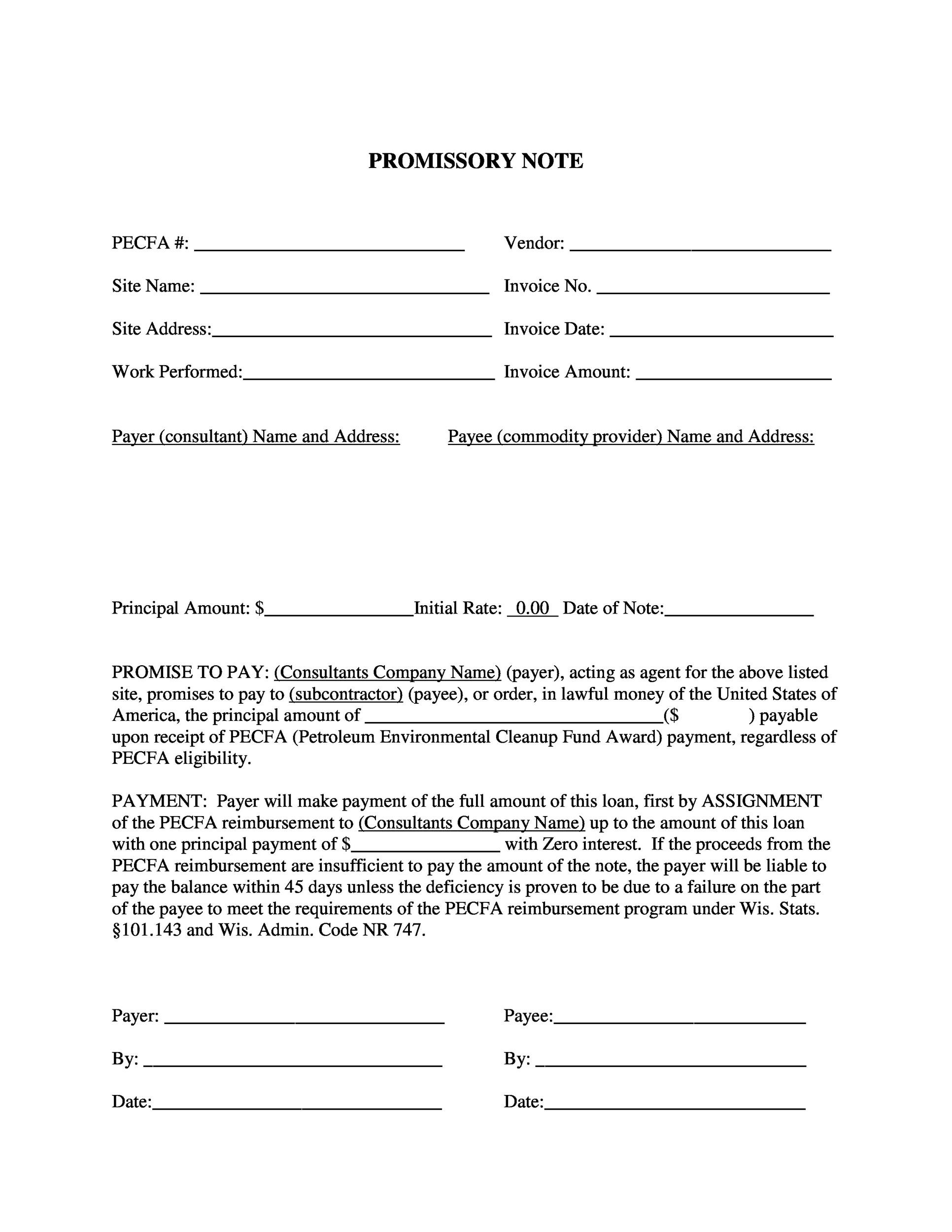

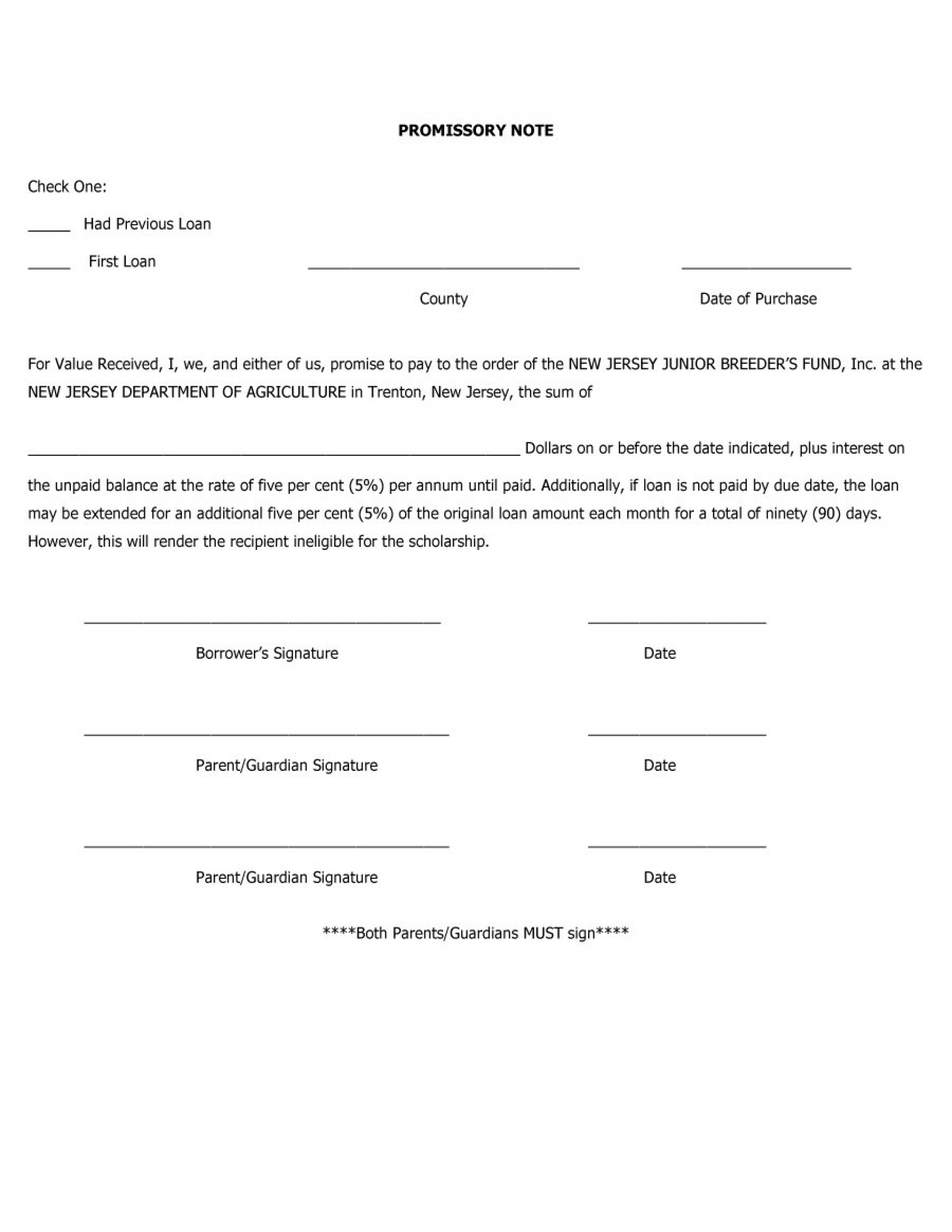

Free Printable Promissory Note - Below we analyze the promissory note, preparing one, and how usury laws apply to. _____, with a mailing address of _____, (“borrower”), and lender: This standard promissory note (“note”) made on _____, 20____ is by and between: A promissory note can be a big benefit if you are worried about the repayment of a loan. A promissory note documents the borrower’s legally binding promise to repay a loan under certain terms and conditions. You will be able to use the promissory note to govern repayment, to make sure that you can take the collateral that the loan is secured with, or to help establish a. The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the note. A promissory note offers clarity and protection by outlining loan terms such as repayment schedules, interest rates, and collateral. These templates can be edited to add all the information you need giving it a professional look and keeping the locations for signatures open. A promissory note is a written promise to pay back money owed within a specific timeframe. Below we analyze the promissory note, preparing one, and how usury laws apply to. A promissory note can be a big benefit if you are worried about the repayment of a loan. You will be able to use the promissory note to govern repayment, to make sure that you can take the collateral that the loan is secured with, or to help establish a. _____, with a mailing address of _____, (“lender”). _____, with a mailing address of _____, (“borrower”), and lender: Promissory notes protect the contractual relationship between the lender and the borrower and are essential debt instruments in businesses and personal finance. A promissory note offers clarity and protection by outlining loan terms such as repayment schedules, interest rates, and collateral. A promissory note is a written promise to pay back money owed within a specific timeframe. People who cannot qualify to obtain mortgages to buy a home can still do so using a promissory note template. These templates can be edited to add all the information you need giving it a professional look and keeping the locations for signatures open. A promissory note can be a big benefit if you are worried about the repayment of a loan. The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the note. These templates can be edited to add all the information you need giving it a professional look and keeping. The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the note. Unlike an iou that only acknowledges a debt amount, a promissory note details the consequences of failing to repay a loan. You will be able to use the promissory note to govern repayment, to make sure that. _____, with a mailing address of _____, (“borrower”), and lender: The full balance of this note, including all accrued interest and late fees, is due and payable on the ___ day of _______________, 20___, hereinafter known as the due date. These templates can be edited to add all the information you need giving it a professional look and keeping the. A promissory note can be a big benefit if you are worried about the repayment of a loan. A promissory note documents the borrower’s legally binding promise to repay a loan under certain terms and conditions. A promissory note is a written promise to pay back money owed within a specific timeframe. You will be able to use the promissory. This simple yet powerful document fosters trust and accountability, helping prevent disputes. The full balance of this note, including all accrued interest and late fees, is due and payable on the ___ day of _______________, 20___, hereinafter known as the due date. A promissory note can be a big benefit if you are worried about the repayment of a loan.. A promissory note is a written promise to pay back money owed within a specific timeframe. By using these promissory note templates, you are letting each person involved in the transaction know that it is a serious transaction and that payment needs to be paid back at the time specified. Unlike an iou that only acknowledges a debt amount, a. People who cannot qualify to obtain mortgages to buy a home can still do so using a promissory note template. _____, with a mailing address of _____, (“lender”). The full balance of this note, including all accrued interest and late fees, is due and payable on the ___ day of _______________, 20___, hereinafter known as the due date. _____, with. You will be able to use the promissory note to govern repayment, to make sure that you can take the collateral that the loan is secured with, or to help establish a. The full balance of this note, including all accrued interest and late fees, is due and payable on the ___ day of _______________, 20___, hereinafter known as the. Promissory notes protect the contractual relationship between the lender and the borrower and are essential debt instruments in businesses and personal finance. These templates can be edited to add all the information you need giving it a professional look and keeping the locations for signatures open. A promissory note documents the borrower’s legally binding promise to repay a loan under. Unlike an iou that only acknowledges a debt amount, a promissory note details the consequences of failing to repay a loan. You will be able to use the promissory note to govern repayment, to make sure that you can take the collateral that the loan is secured with, or to help establish a. This standard promissory note (“note”) made on. A promissory note can be a big benefit if you are worried about the repayment of a loan. A promissory note is a written promise to pay back money owed within a specific timeframe. By using these promissory note templates, you are letting each person involved in the transaction know that it is a serious transaction and that payment needs to be paid back at the time specified. The full balance of this note, including all accrued interest and late fees, is due and payable on the ___ day of _______________, 20___, hereinafter known as the due date. The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the note. People who cannot qualify to obtain mortgages to buy a home can still do so using a promissory note template. A promissory note documents the borrower’s legally binding promise to repay a loan under certain terms and conditions. Unlike an iou that only acknowledges a debt amount, a promissory note details the consequences of failing to repay a loan. You will be able to use the promissory note to govern repayment, to make sure that you can take the collateral that the loan is secured with, or to help establish a. This standard promissory note (“note”) made on _____, 20____ is by and between: _____, with a mailing address of _____, (“lender”). These templates can be edited to add all the information you need giving it a professional look and keeping the locations for signatures open. This simple yet powerful document fosters trust and accountability, helping prevent disputes.45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

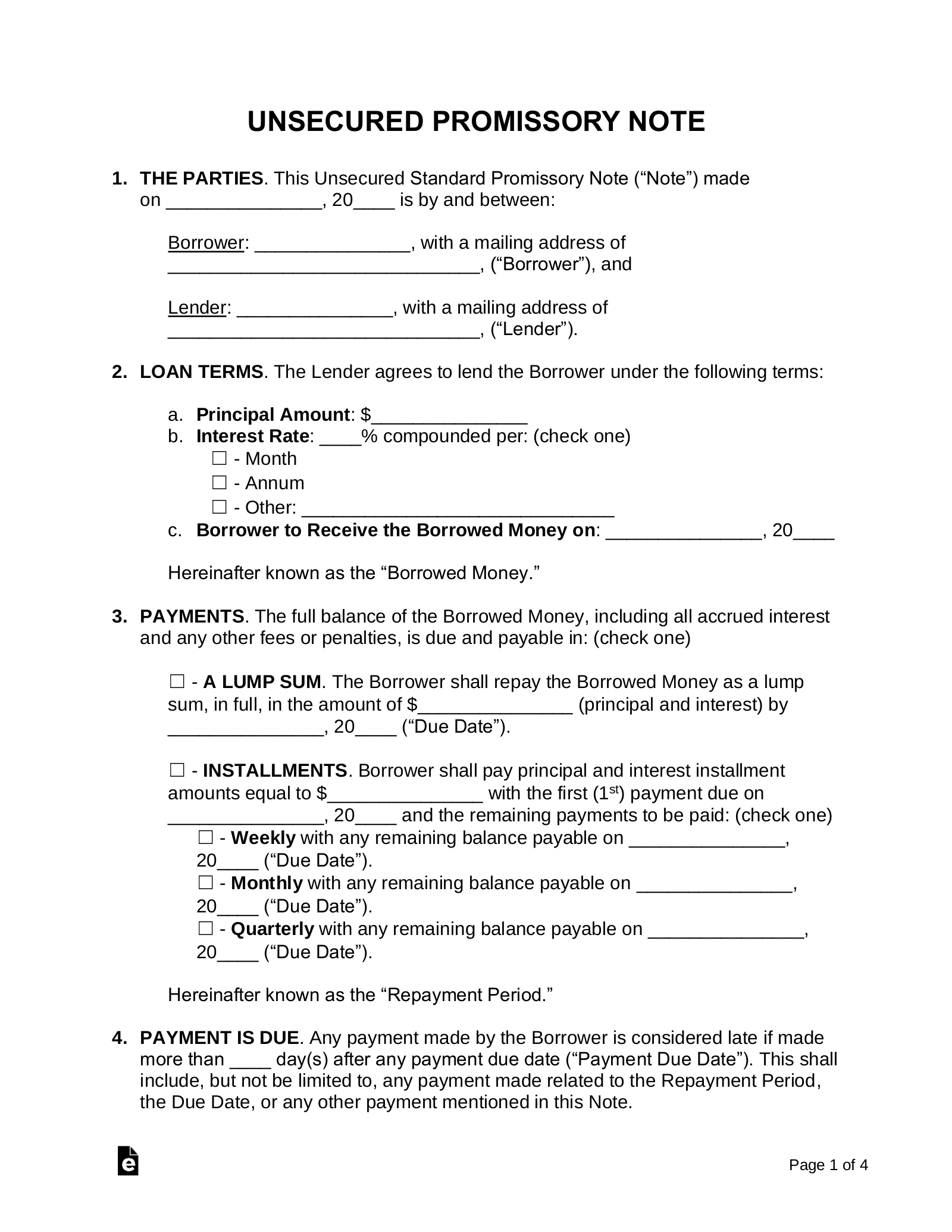

Free Unsecured Promissory Note Template PDF Word eForms

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Promissory Loan Agreement Template

sample free promissory note loan release form word pdf florida

Printable Simple Promissory Note Template

Printable Promissory Note Template

Promissory Note Word Template

Free Printable Promissory Note For Personal Loan Free Printable

Below We Analyze The Promissory Note, Preparing One, And How Usury Laws Apply To.

A Promissory Note Offers Clarity And Protection By Outlining Loan Terms Such As Repayment Schedules, Interest Rates, And Collateral.

Promissory Notes Protect The Contractual Relationship Between The Lender And The Borrower And Are Essential Debt Instruments In Businesses And Personal Finance.

_____, With A Mailing Address Of _____, (“Borrower”), And Lender:

Related Post:

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-32.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-34.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-02.jpg)