Form 8332 Printable

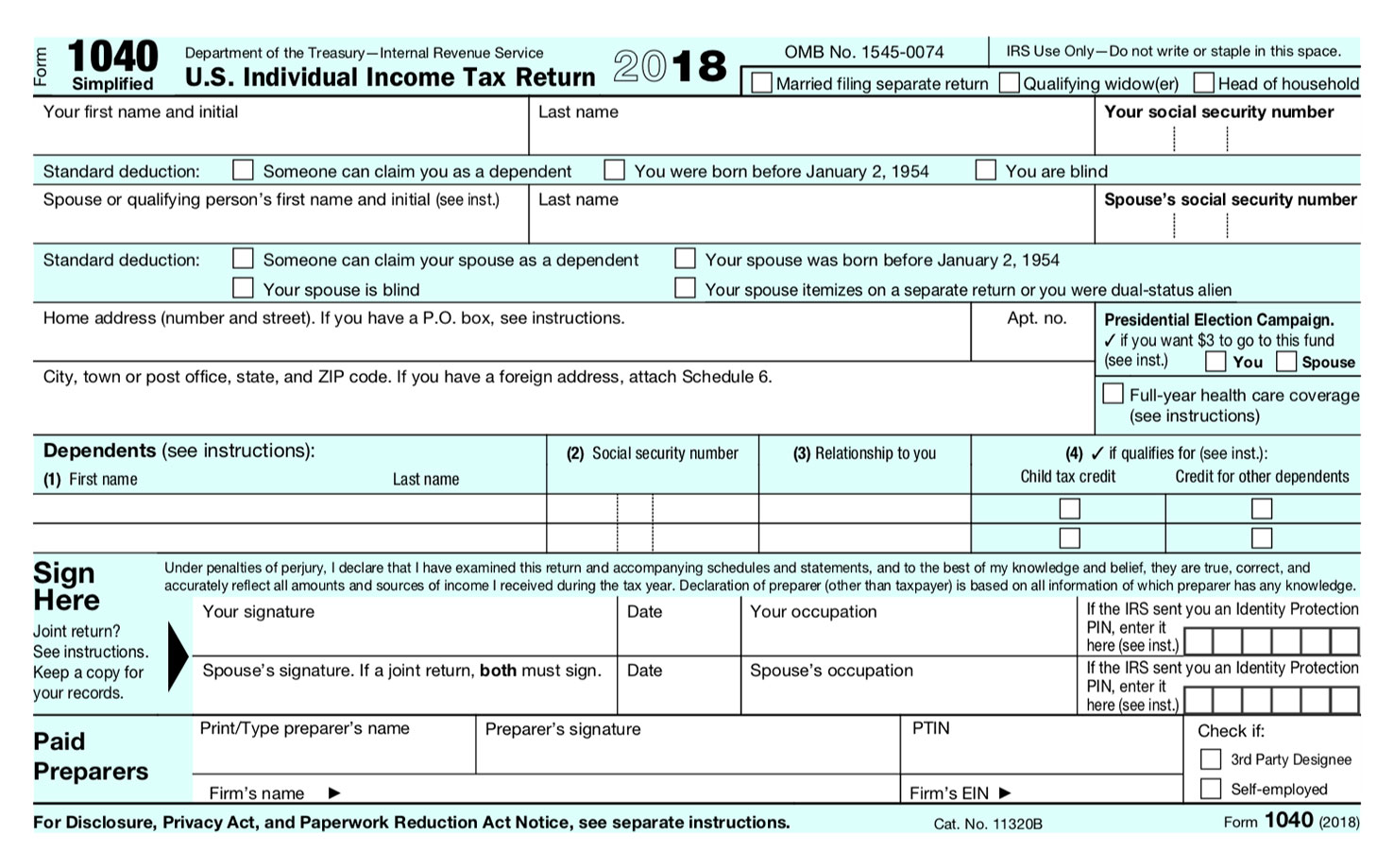

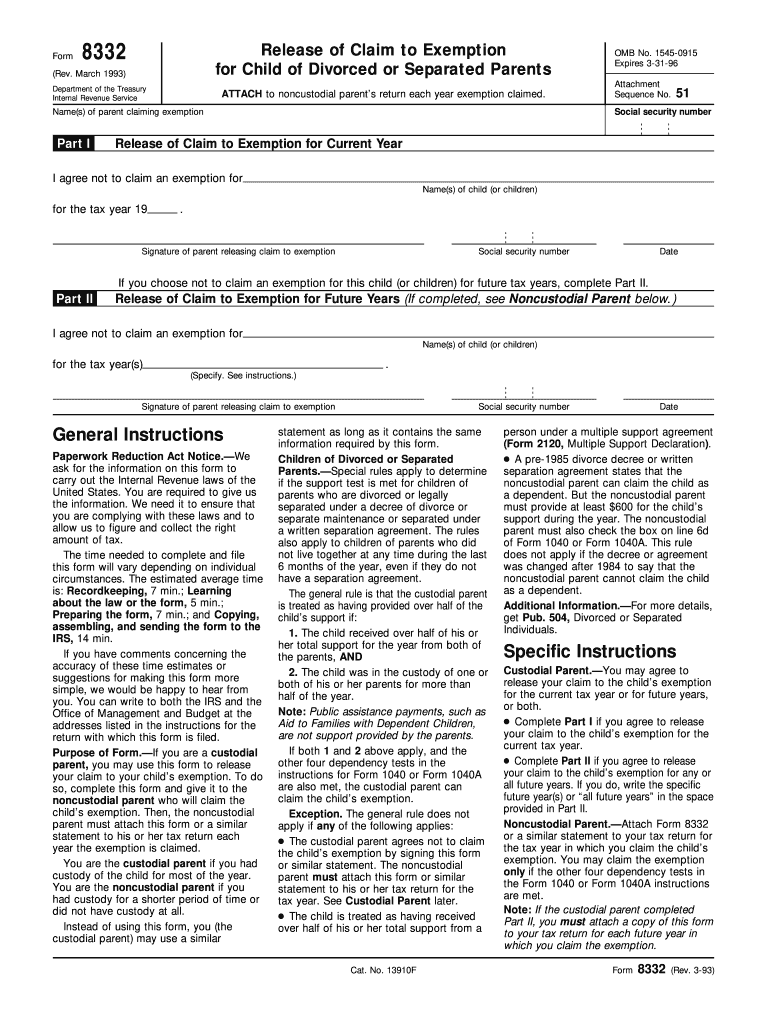

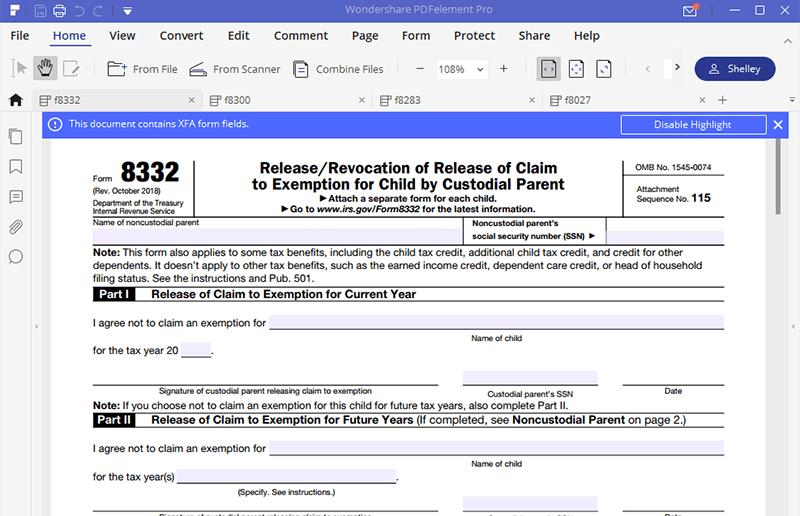

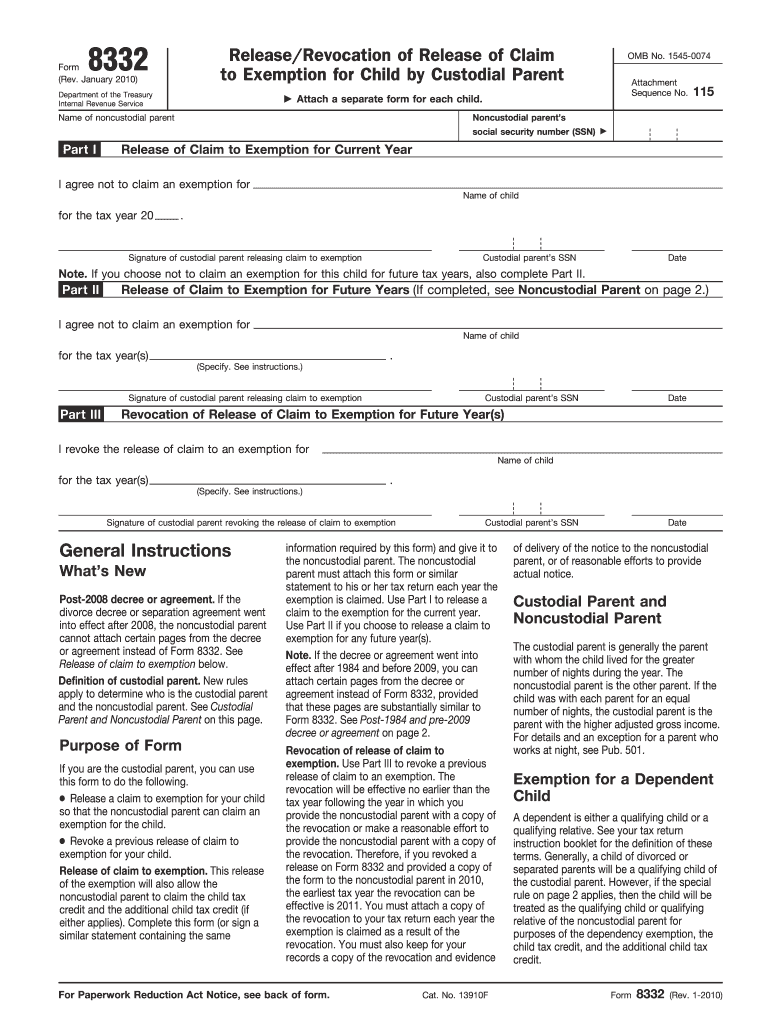

Form 8332 Printable - This form is particularly relevant for separated or. Download or print the 2024 federal form 8332 (release/revocation of release of claim to exemption for child by custodial parent) for free from the federal internal revenue service. To claim the earned income credit on your taxes using irs form 8332, you must meet the eligibility requirements for the credit and provide the necessary information on the form. If you, your spouse, and the child all live in the same household all year, you do not need form 8332. If you want a pdf, make sure your printer setting options are set for pdf. Use form 8332 when a custodial parent agrees to release a claim to a child's tax exemption for the noncustodial parent, especially following a divorce or separation. You can also print a copy of form 8453 here: Once you indicate in turbotax that you have a form 8332, a form 8453 will generate for printing. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. Electronically, you must file form 8332 with form 8453, u.s. If you are the custodial parent (for a child), you can use irs form 8332, release/revocation of release of claim to exemption for child by custodial parent.. To claim the earned income credit on your taxes using irs form 8332, you must meet the eligibility requirements for the credit and provide the necessary information on the form. The form isn't listed in the client form list. Form 8332 is generally attached to the claimant's tax return. The form 8332 can be found here: Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and. Download or print the 2024 federal form 8332 (release/revocation of release of claim to exemption for child by custodial parent) for free from the federal internal revenue service. You can also print a copy of form 8453 here: Use form 8332 when a custodial parent agrees to release a claim to a child's tax exemption for the noncustodial parent, especially following a divorce or separation. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. If you are the custodial parent (for a child), you can use irs form 8332, release/revocation of release of claim to exemption for child by custodial parent.. Once you indicate in turbotax that you have a form 8332, a form 8453 will generate for printing. Information about form 8332, release/revocation of release of claim to exemption for child by custodial. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and. That form is for situations where the parents live. The form isn't listed in the client form list. Use form 8332 when a custodial parent agrees to release a claim to a child's tax exemption for the noncustodial parent, especially following a divorce or separation. Download or print the 2024 federal form 8332 (release/revocation of release of claim to exemption for child by custodial parent) for free from the. Electronically, you must file form 8332 with form 8453, u.s. You can also print a copy of form 8453 here: Form 8332 is generally attached to the claimant's tax return. If you want a pdf, make sure your printer setting options are set for pdf. That form is for situations where the parents live separately, the child. The release of the dependency exemption will also release to the. If you, your spouse, and the child all live in the same household all year, you do not need form 8332. If you are the custodial parent (for a child), you can use irs form 8332, release/revocation of release of claim to exemption for child by custodial parent.. To. Electronically, you must file form 8332 with form 8453, u.s. Once you indicate in turbotax that you have a form 8332, a form 8453 will generate for printing. If you, your spouse, and the child all live in the same household all year, you do not need form 8332. If you are a custodial parent, you can use this form. Right click on the tab for the form and click on print. Use form 8332 when a custodial parent agrees to release a claim to a child's tax exemption for the noncustodial parent, especially following a divorce or separation. If you, your spouse, and the child all live in the same household all year, you do not need form 8332.. You can also print a copy of form 8453 here: To claim the earned income credit on your taxes using irs form 8332, you must meet the eligibility requirements for the credit and provide the necessary information on the form. The form 8332 can be found here: Use form 8332 when a custodial parent agrees to release a claim to. Form 8332 is generally attached to the claimant's tax return. The form 8332 can be found here: Electronically, you must file form 8332 with form 8453, u.s. The form isn't listed in the client form list. If you are the custodial parent (for a child), you can use irs form 8332, release/revocation of release of claim to exemption for child. Form 8332 is generally attached to the claimant's tax return. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. Right click on the tab for the form and click on print. If you are a custodial parent, you can use. If you, your spouse, and the child all live in the same household all year, you do not need form 8332. Form 8332 is generally attached to the claimant's tax return. You can also print a copy of form 8453 here: If you are the custodial parent (for a child), you can use irs form 8332, release/revocation of release of claim to exemption for child by custodial parent.. The release of the dependency exemption will also release to the. This form is particularly relevant for separated or. Once you indicate in turbotax that you have a form 8332, a form 8453 will generate for printing. If you want a pdf, make sure your printer setting options are set for pdf. See form 8453 and its instructions for more details. Electronically, you must file form 8332 with form 8453, u.s. To complete form 8332 in turbo tax, type revocation of release of claim to exemption for child of divorced or separated parents. Right click on the tab for the form and click on print. That form is for situations where the parents live separately, the child. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. Download or print the 2024 federal form 8332 (release/revocation of release of claim to exemption for child by custodial parent) for free from the federal internal revenue service. To claim the earned income credit on your taxes using irs form 8332, you must meet the eligibility requirements for the credit and provide the necessary information on the form.Simplified Tax Form? NESA

Tax Form 8332 Printable

Tax Form 8332 Printable

IRS Form 8332 Fill it with the Best PDF Form Filler

Irs Form 8332 Fillable

Tax Form 8332 Printable

Tax Form 8332 Printable

Ir's Form 8332 Fill Out and Sign Printable PDF Template airSlate

IRS Form 8332 Fill it with the Best PDF Form Filler

Irs Form 8332 Printable

The Form Isn't Listed In The Client Form List.

Information About Form 8332, Release/Revocation Of Release Of Claim To Exemption For Child By Custodial Parent, Including Recent Updates, Related Forms, And.

Use Form 8332 When A Custodial Parent Agrees To Release A Claim To A Child's Tax Exemption For The Noncustodial Parent, Especially Following A Divorce Or Separation.

If You Are A Custodial Parent, You Can Use This Form To Release Your Claim To A Dependency Exemption For Your Child.

Related Post: